Spectacular Info About How To Avoid Whipsaw

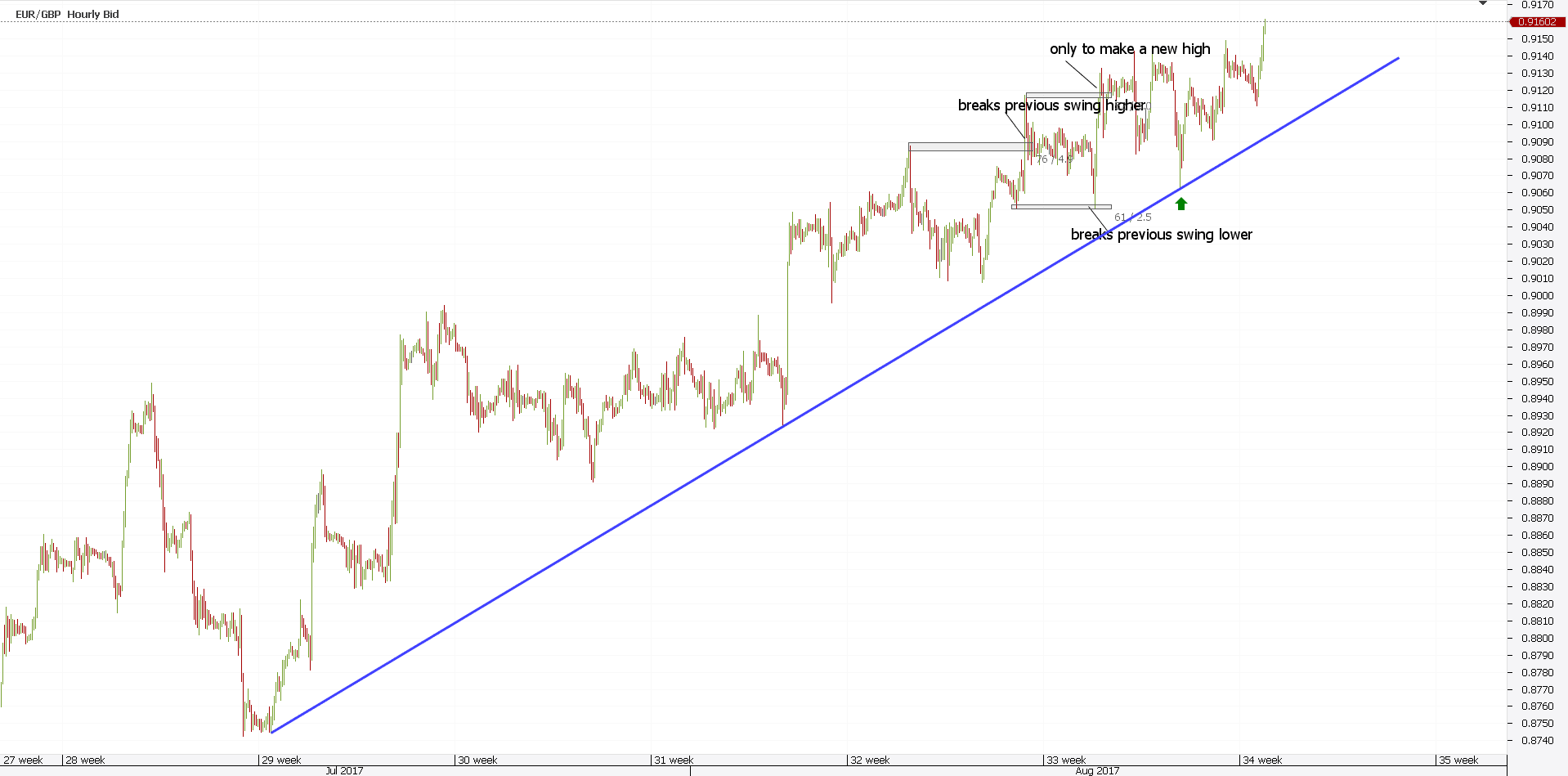

Allow for swings, but keep in mind that it’s a risky event, therefore we.

How to avoid whipsaw. Simply enter trade, place trailing stop and check back at closing. “we are retaping our futures course live, be part of it, learn more about this once every 3 year opportunity: Solution is not in the signal.

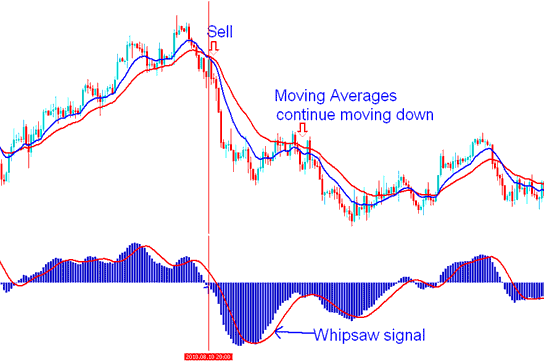

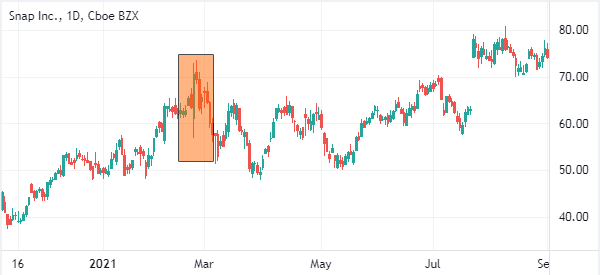

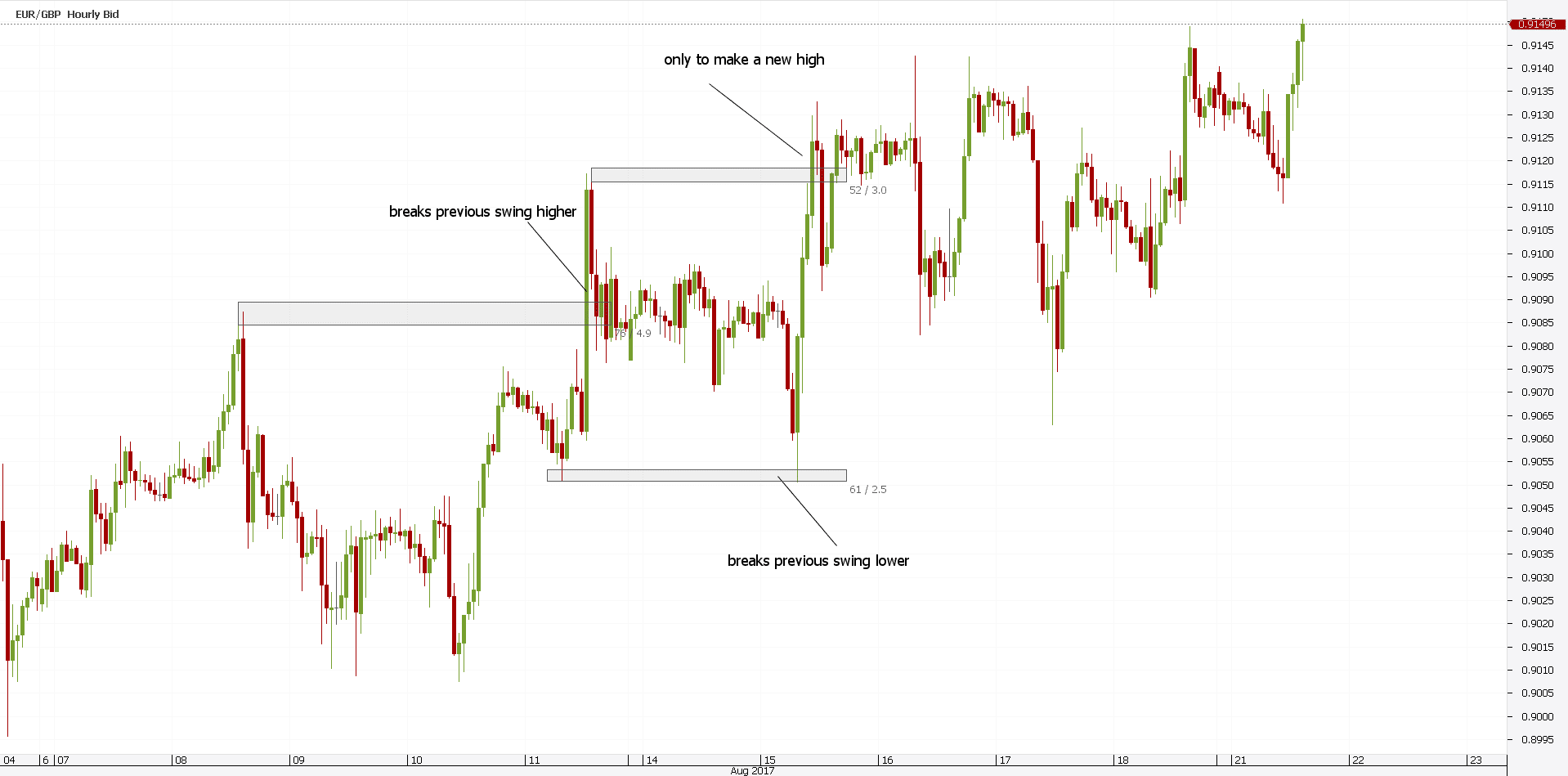

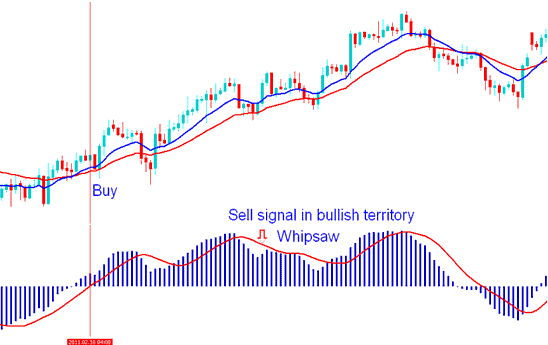

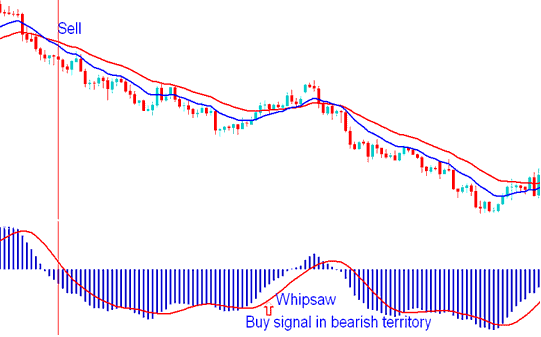

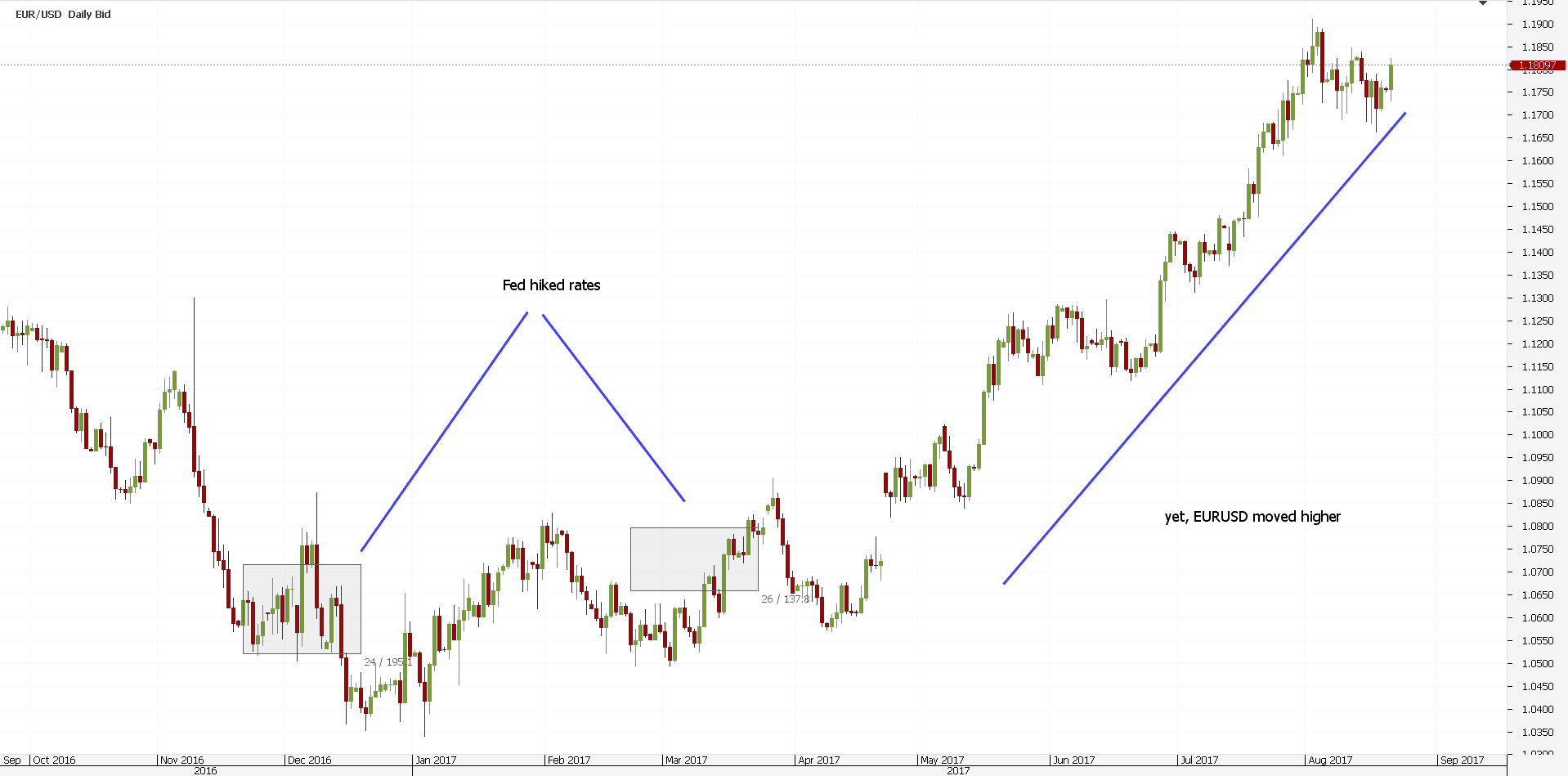

Whipsaw in trading describes a sharp increase or decrease in an asset’s price, which goes against the prevailing trend. Do not be overly concerned about whipsaws a good trend pays for them all. Precautions to protect you from whipsaws.

A potential solution:one way to avoid these problems is to allow cash balance plans to define the accrued benefit as the account balance. Your question refers to trends flattening into sideways markets. The basic thought here is that pinnacle is going to use the non union at colgan to go up against the unionized pinnicle guys for new aircraft and new flying pitting you against each other in your contract negotiations.

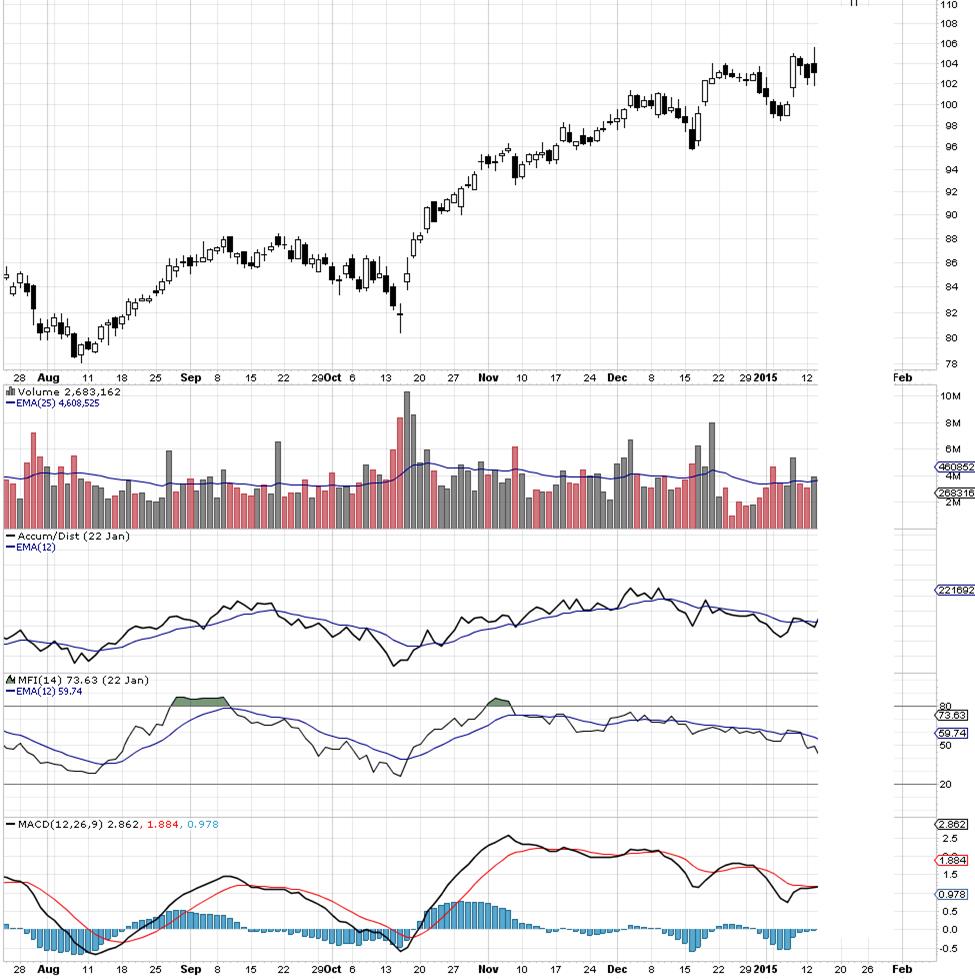

With the market so volatile lately, it might be a difficult to avoid getting stopped out. Using more than one of them will just add confusion. Dealing with whipsaw in trading.

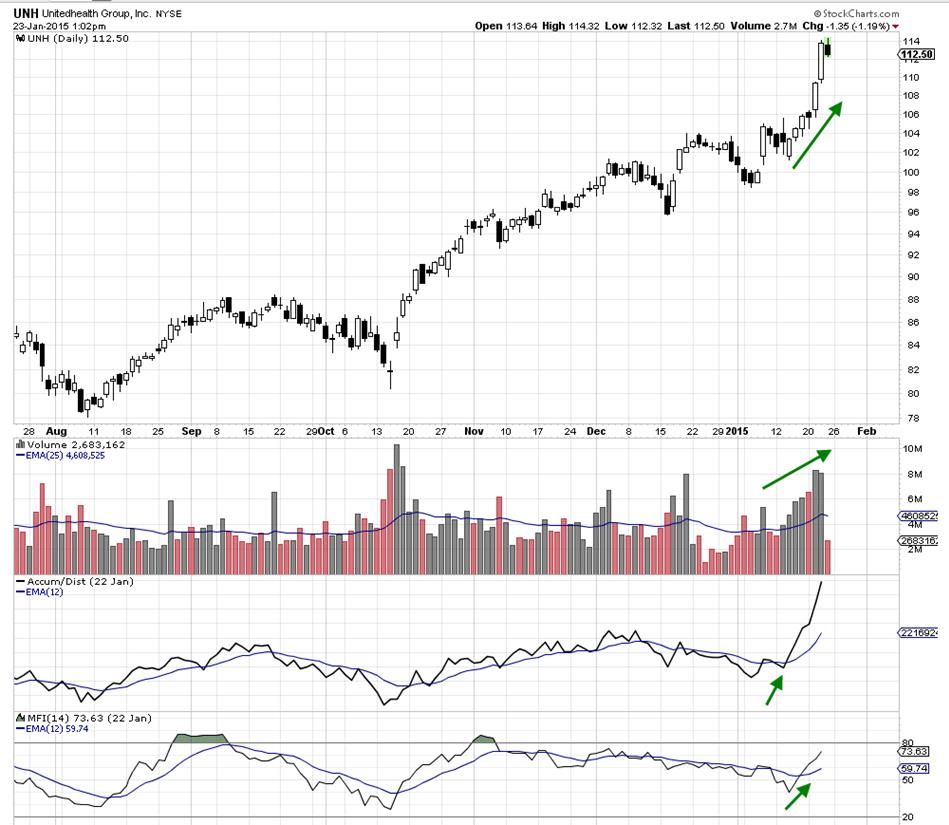

Avoid the desire of trying to get even with the market. Don't even look at it, i am serious. The most powerful signal in technical analysis is the divergence.

What is whipsaw in trading and how to avoid it? Learn to use it if you are going to use these indicators. Whipsaw how to avoid whipsaws in tradinghow to avoid whipsa.