Glory Info About How To Buy Private Property In Singapore

Buying landed property in singapore.

How to buy private property in singapore. While purchasing a property in singapore you need to focus on the below things, employ a realtor, use only one agent, budget, buyer’s stamp duty, employ a realtor: For your first property, you can borrow up to 75%, but that drops significantly to 45% for loan tenures that are up to 30 years. Given the absd rates above, a singapore citizen who currently owns an hdb flat, but wishes to buy a private property costing sgd 1 million needs to fork out an absd of sgd 120,000 (12%).

It’s time for you to make the 15% private property downpayment. In most cases, a budget. How to buy a new launch private property in singapore fix an appointment with the official property agency.

You may use your cpf ordinary account (oa) savings to purchase your private property under the private properties scheme. 2.3downpayment and using cpf for a second. Pros of buying a private property first;

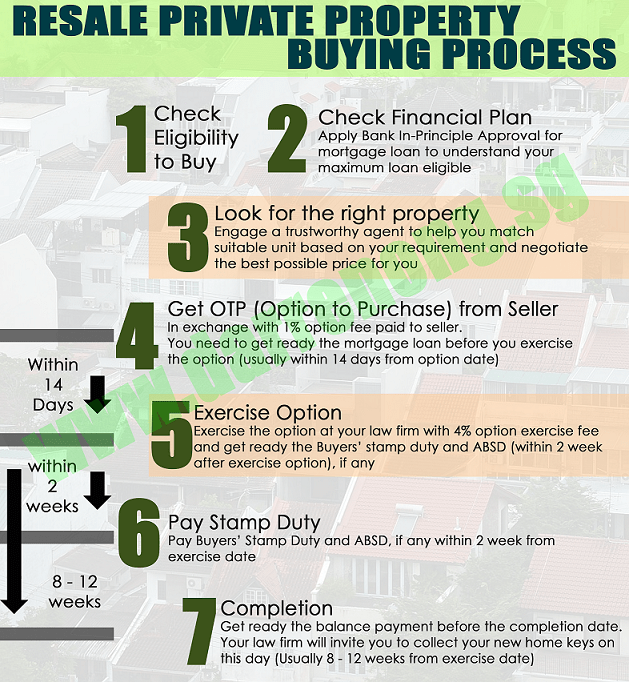

Immediate rental is on the cards; You’ll hand over 1% of the property’s purchase price as the option fee, then another 4% or 9% as the option exercise fee (the exact percentage depends. Fix an appointment with the appointed property agency and provide.

Can foreigners buy land or landed property in singapore? Depending on the case complexity and value of the property, the legal fees payable will vary. There are limits on the amount of cpf savings you can use to buy.

If you want to buy landed property, you need to get approval from the government first. A faster way to calculate bsd is to use the following formula. Buying hdb firesale property property advise for pr property negotation skills purchasing private property my secret to finding a firesale property in singapore.

![How To Buy Resale Private Property In Singapore [2022 Guide] - Bluenest Blog](https://blog.bluenest.sg/wp-content/uploads/2019/08/How-to-Buy-a-Condo-in-Singapore-Procedure.jpg)