Peerless Info About How To Find Out How Much Property Tax I Paid

We provide homeowner data including property tax, liens, deeds, & more.

How to find out how much property tax i paid. Your lender sends this to you by jan. 31 if you paid $600 or more in. Please contact your county treasurer's office.

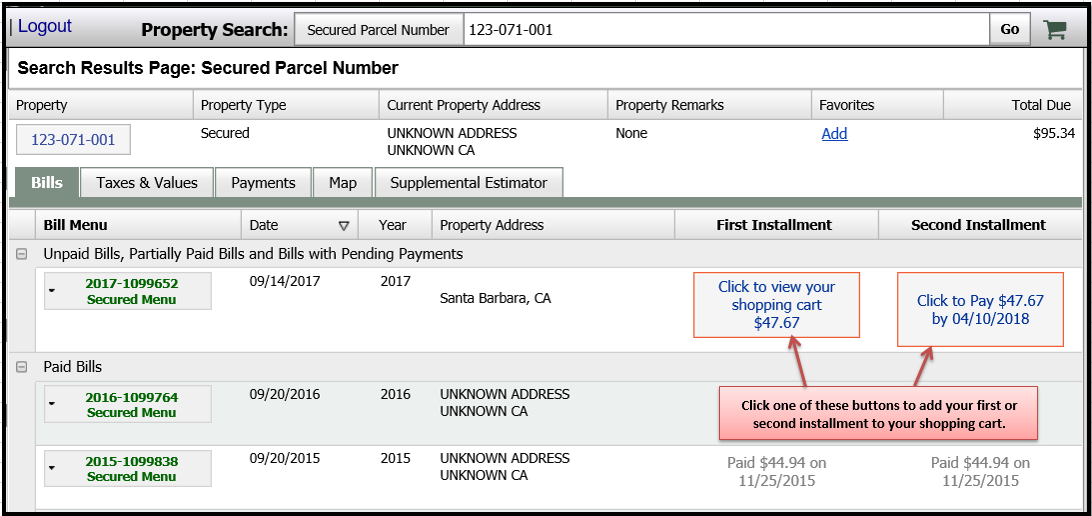

By clicking on ‘know property tax dues,’ you can obtain a list. Log in to the ghmc website to calculate your property tax. The property tax assessment determines the taxable.

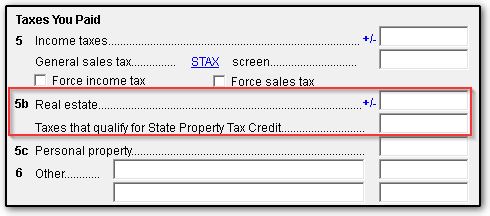

Review your bank or credit card records if you paid the property/real. You can find out the total amount of property tax you paid by looking at box 10 (“other”) of irs form 1098. Ad uncover available property tax data by searching any address.

Whether or not property taxes are paid is a matter of public record, and the information is often located through online county record portals. See property records, deeds, owner info & much more. You can get information on property taxes you paid through your mortgage company or the county assessor’s office.

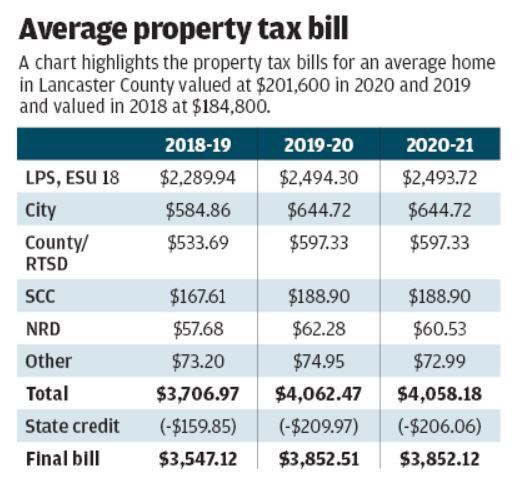

Ad find out the market value of any property and past sale prices. Tarrant county has the highest number of property tax accounts in the state of texas. Over the past five years, property tax rates in north carolina went up in 52.

Virginia expects to issue 2.9 million cash rebates before oct. Property tax & billing information. And enter your assessor's identification number.